Is Your Air Conditioner a Symbol of American Economic Power?

It’s a strange thought. The cool air that makes life possible in a Dubai skyscraper, a Riyadh data center, or a Doha hospital is often governed by a set of rules written over 7,000 miles away in Arlington, Virginia. We call it AHRI certification. We’re told it’s a simple badge of quality, a technical benchmark for performance.

But what if it’s more than that?

What if a technical standard is also an instrument of influence? A quiet, persistent form of economic soft power that shapes markets, dictates specifications, and reinforces a global hierarchy. The story of AHRI in the Middle East isn’t just about BTUs and efficiency ratings. It’s a masterclass in how leadership, once established, becomes the status quo.

A friend, an engineer working on a massive infrastructure project in the Gulf, once told me, “We don’t even think about it. The tender says ‘AHRI-certified.’ It’s the default. To suggest otherwise is to invite confusion, delays, and risk.” His words stuck with me. When a choice becomes so automatic it’s no longer a choice, you have to ask: who benefits from the default?

Why Is an American Standard Dominant in the Middle East?

The Air-Conditioning, Heating, and Refrigeration Institute (AHRI) provides a valuable service: independent verification that HVACR equipment performs as claimed. It’s a mark of trust. But its journey to becoming the default standard in the Middle East is rooted in the history of 20th-century commerce.

American engineering firms and multinational corporations led the global charge in the post-war era. They brought their standards, their systems, and their specifications with them. Standards like those from ASHRAE and AHRI weren’t just technical documents; they were part of the American industrial operating system. When the Middle East began its extraordinary phase of development, it imported not just equipment, but the entire ecosystem of design and quality assurance that came with it.

This created a self-reinforcing loop:

- Consultants Specify It: International (often Western-trained) engineers specify AHRI because it’s the standard they know, trust, and are trained on.

- Manufacturers Comply: To access the lucrative U.S. market, global manufacturers must invest in AHRI certification. Having done so, they promote that same standard in other regions, like the Middle East, to maximize their return on that investment.

- Governments Accept It: Local regulatory bodies, needing robust energy efficiency standards, find it easier to adopt or align with a globally recognized, ready-made framework like AHRI rather than building a costly parallel system from scratch.

This isn’t a conspiracy; it’s the physics of economic gravity. The largest, most established body exerts the strongest pull. AHRI’s dominance is less a conscious power grab and more a quiet inheritance of America’s long-standing industrial predominance.

Does the End-User Pay for This Dominance?

Yes. Absolutely.

Certification is not free. The rigorous third-party testing, the administrative fees, and the engineering required to meet specific performance benchmarks all add cost. That cost is baked into the price of the equipment.

Think of it as a tax for market access. This “AHRI tax” is paid by the manufacturer, who then passes it to the contractor, who includes it in the project bid for the developer. Ultimately, the cost is borne by the final client or end-user—the business renting the office, the family buying the apartment, the government funding the hospital.

Does this make the final product more expensive? Compared to a non-certified alternative, yes. The justification is that you’re paying a premium for guaranteed performance, lower operating costs, and reliability. But it also means the market is structured in a way that financially benefits the ecosystem built around that standard. Every time a project specifies AHRI, it reinforces the value and necessity of the certification, ensuring a steady revenue stream for the institute and the network of labs and consultants that support it. This is the subtle genius of setting the standard: you don’t need to sell a product when you can sell the very rules of the market.

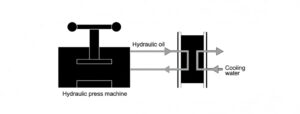

For those managing complex systems, ensuring performance is critical. You can use a heat exchanger calculator to model your needs, but the components you source will almost certainly need to fit within this certification framework.

H2: What Are the Alternatives to This American Predominance?

For decades, there was little competition. But the world is changing. A multipolar economic landscape demands a multipolar standards environment.

The most significant alternative, especially from a European perspective, is Eurovent. While long-dominant in Europe, it is now making a direct play for the Middle East. Recognizing that standards designed for Virginia or Brussels may not be ideal for the Arabian Desert, Eurovent Middle East recently launched a “Desert Certification” program. This is the first high-ambient temperature testing scheme explicitly designed for the Gulf’s climate.

This isn’t just a technical move; it’s a geopolitical one. It is a declaration of independence from a U.S.-centric view of performance. It signals a shift toward regional self-determination in standards, creating a competitive environment where end-users can choose a certification that most accurately reflects their real-world operating conditions.

Choosing the right system, and ensuring its longevity, requires a deep understanding of the market’s standards. Whether you’re making an initial GPHE selection or sourcing reliable GPHE spare parts, the certification mark on that equipment is the end result of this global economic dynamic.

Is the Default Always the Right Choice?

The quiet dominance of a single standard, no matter how robust, is worth questioning. It builds dependency and can stifle innovation from those outside the ecosystem. While AHRI provides undeniable value, its position in the Middle East is a powerful reminder that the most influential forces are often the ones we’ve been taught not to see.

The next time you walk into a blissfully cool building in the heart of a desert, ask yourself: What unseen systems—of commerce, history, and influence—are working to make this moment possible? The answer is far more complex than simple air conditioning. It’s about who gets to write the rules.

Of course. Here is a summary of the global adoption of AHRI certification, presented in a clear, visual table.

Global AHRI Certification Adoption at a Glance

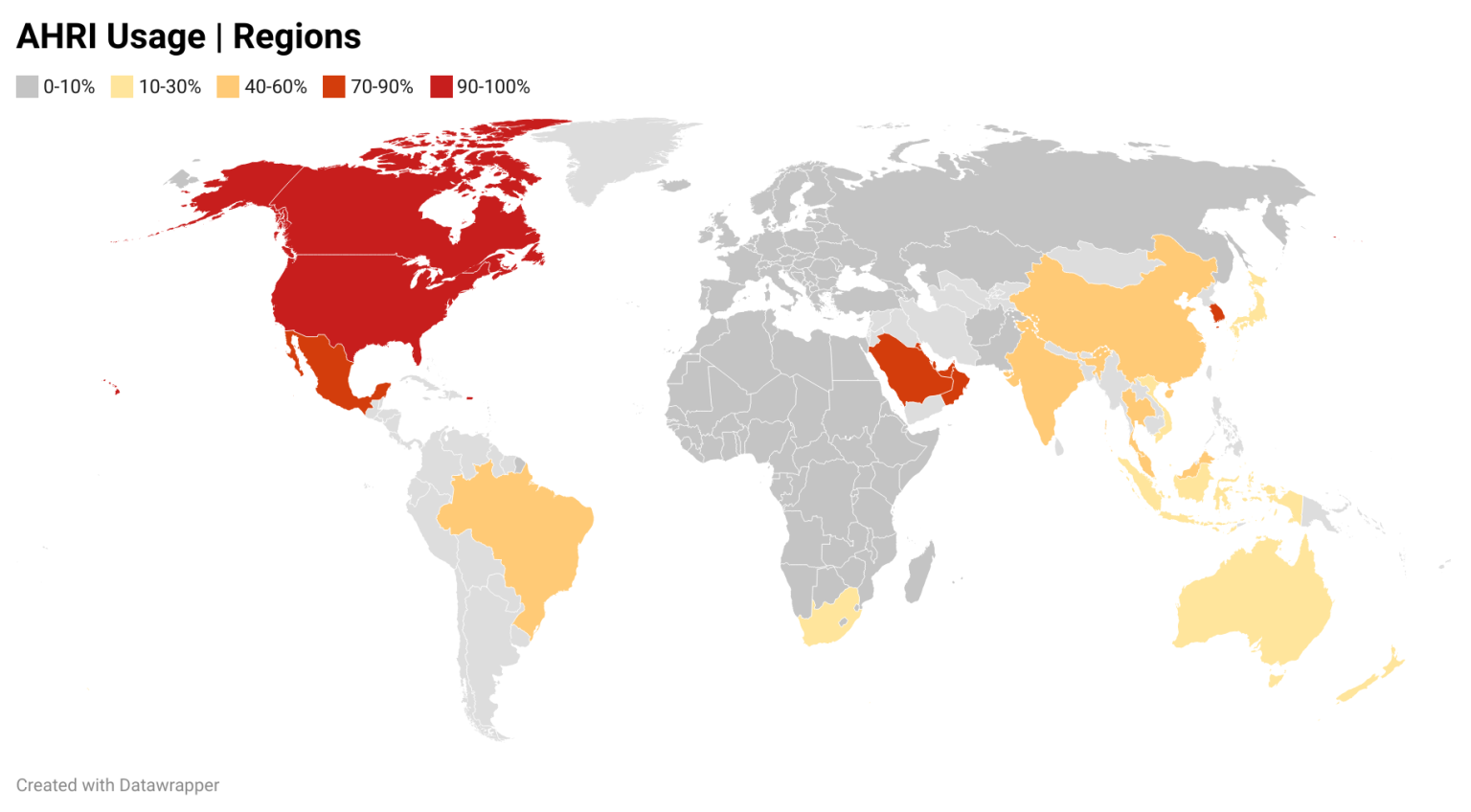

| Adoption Tier | Est. Project Requirement | Key Regions & Countries | Status & Market Drivers |

| Tier 1 | 90-100% | • United States • Canada | Mandatory / De Facto Standard • Legally required for federal rebates (ENERGY STAR) & tax credits. • Embedded in national and local building codes. • The unquestioned baseline for market entry and compliance. |

| Tier 2 | 70-90% | • UAE • Saudi Arabia • Qatar • Kuwait • Mexico • South Korea | Dominant & Widely Specified • The default standard for all major commercial and government projects. • Aligned with local energy standards (e.g., SASO, ESMA). • Driven by international engineering consultants and high-ambient performance needs. |

| Tier 3 | 40-60% | • India • Brazil • Singapore • Malaysia • China (Export) | Significant & Growing • A strong mark of quality, co-existing with local standards. • A recognized path for compliance with national programs (e.g., India’s BEE). • Essential for manufacturers targeting global export markets. |

| Tier 4 | 10-30% | • Australia • New Zealand • Japan | Accepted Pathway / Niche Use • Recognized as one of several valid international standards for compliance. • Coexists with strong local or regional standards (AS/NZS, JIS). • Used for specific projects or imported equipment. |

| Tier 5 | <10% | • European Union • United Kingdom | Alternative Standard Dominates • The market is overwhelmingly dominated by Eurovent certification. • Local standards are aligned with EU regulations (Ecodesign Directive). • AHRI is recognized but rarely specified. |

External References: